Our Investment Process

Decades of experience in financial services guides our investment selection, evaluation and structuring.

Proprietary Sourcing

Our investment team uses its collective expertise to identify attractive opportunities and leverages its global network of partners to source proprietary investments. The Firm’s expertise in financial services has made JCF a sought after partner for industry leaders and often positions us on the “short list” of desired investors in complex situations requiring capital.

Rigorous and Analytical Due DiligenCE

JCF seeks to evaluate investment opportunities with agility and efficiency, quickly honing in on the most significant issues in the due diligence process.

Disciplined Execution

When negotiating transactions, we seek to structure investments to maximize governance, legal, and economic protections, utilizing a variety of risk-mitigation strategies (e.g., pricing ratchets, hedges, staged management equity).

Collaborative Partnership to Drive Value Creation

JCF actively partners with the management of our portfolio companies, rolling up our sleeves to identify and execute on strategies to increase the value of our portfolio companies.

Strategic Realization

We understand that creating real value in companies takes time, often several years. We seek to exit our investments after determining that value has been optimized for our limited partners, taking into account the interests of all stakeholders. Throughout the investment process and during our ownership, our investment team considers a range of potential exit scenarios.

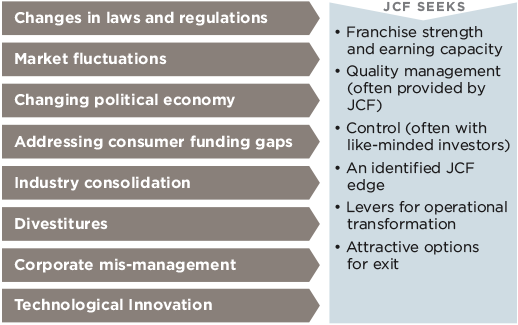

INVESTMENT STRATEGY

A number of major trends in financial services create both disruption and opportunities for investment in our core sectors.